Secure Payment Processing Solutions

Our AI-powered secure payment processing solutions and fraud protection services help you prevent chargebacks, stop fraudulent transactions, and ensure seamless, PCI-compliant payments — all while improving transaction success rates and customer trust.

Trusted by clients worldwide

0+

successfully delivered

projects

0+

years of software

development

experience

0+

countries represented

by our clients

0+

talented developers and

experts on staff

Custom fraud protection & secure payment processing solutions

Our secure payment processing software and fraud protection solutions are tailored to help fintech, e-commerce, and digital platforms recover, modernize, and optimize their payment infrastructure. We combine security, AI, and seamless integrations to deliver reliable, high-performance systems.

Payment system audit & security assessment

Evaluate your existing payment infrastructure to uncover transaction bottlenecks, vulnerabilities, and integration issues that impact performance, compliance, or customer experience.

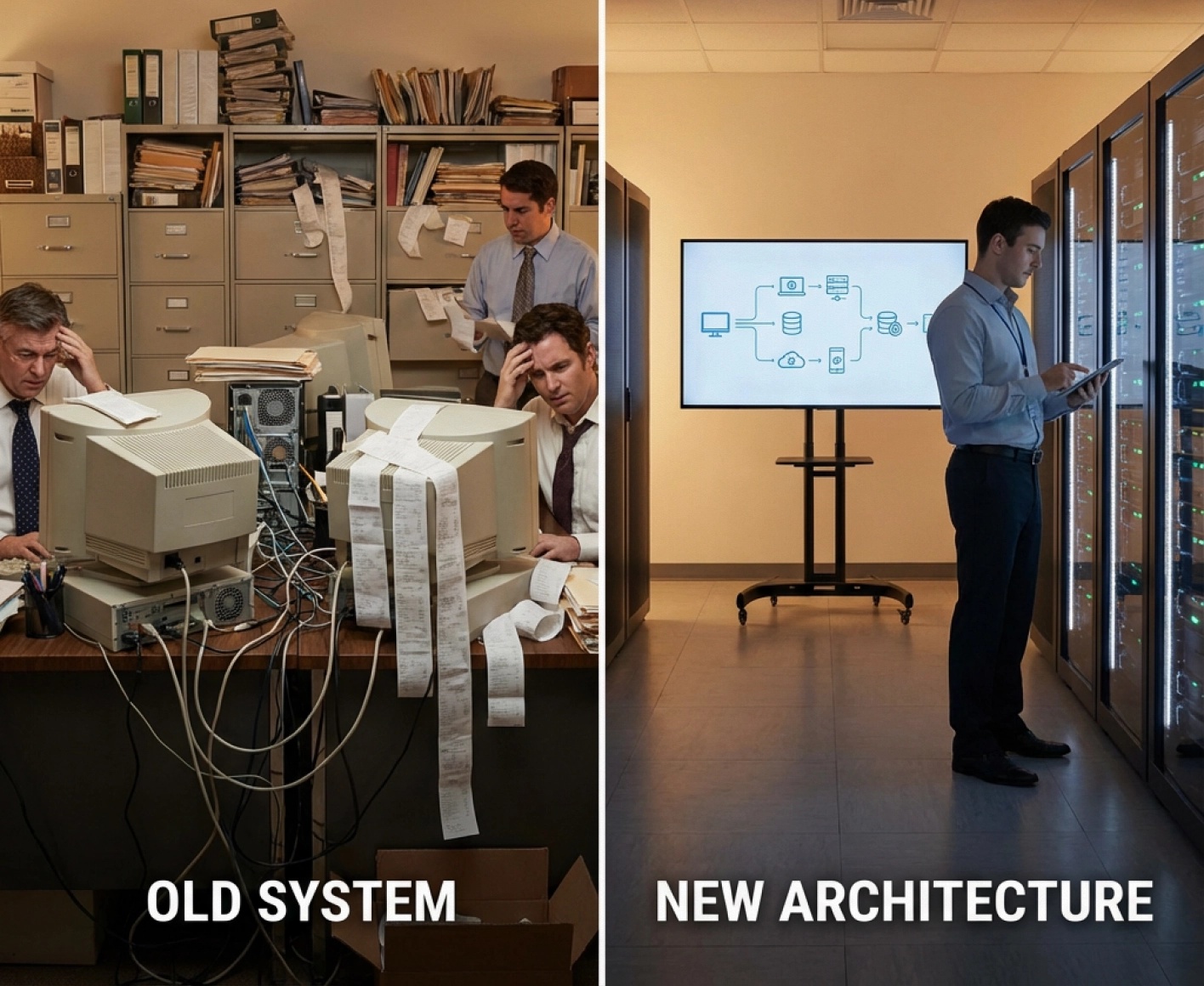

Payment architecture optimization & re‑engineering

Refactor and modernize legacy payment systems to create stable, scalable, PCI-compliant secure payment processing solutions that handle high-volume transactions efficiently and reliably.

AI-driven fraud detection & risk scoring

Analyze transaction behavior, detect anomalies in real time, and prevent fraudulent activity before it affects your revenue using advanced AI and machine learning models.

Secure payment gateway integration & encryption upgrade

Integrate trusted payment gateways and advanced encryption protocols for secure, multi-currency processing and omnichannel payment flows — protecting customer data and reducing disputes.

Omnichannel & third-party system integrations

Connect your payment software to CRMs, ERPs, analytics, and other tools to build a unified financial ecosystem for smarter insights, automation, and risk management.

Performance optimization & continuous maintenance

Maintain peak performance with monitoring, testing, and optimization — ensuring uptime, fast transactions, and evolving compliance while keeping fraud risk low.

Your business deserves secure, high-performing, and future-proof payment systems.

Artificial intelligence solutions for smarter payment security

Onix integrates AI and predictive analytics into payment systems to help fintech and e-commerce companies detect threats early, reduce manual reviews, and ensure frictionless transactions.

AI-driven fraud detection & prevention

AI-driven fraud detection & preventionUse machine learning to identify suspicious activity, detect anomalies, and stop fraudulent transactions instantly. Models continuously learn to reduce false positives and increase accuracy.

Predictive risk analytics & transaction scoring

Predictive risk analytics & transaction scoringForecast risk levels for each transaction with AI-based scoring models, streamline approvals, and reduce friction for legitimate customers.

AI-powered chargeback management

AI-powered chargeback managementDetect chargeback trends, understand causes, and prevent disputes before they occur, recovering lost revenue with automation and predictive analytics.

Intelligent payment optimization

Intelligent payment optimizationAI analyzes transaction data to dynamically route payments through the most reliable gateways, reducing declines and improving authorization rates.

Customer trust & identity verification with AI

Customer trust & identity verification with AIIntegrate facial recognition, behavioral biometrics, and device fingerprinting for secure authentication without slowing checkout.

Your business deserves a secure, high-performing, and future-proof payment system. Protect your payments & prevent fraud today.

Projects we delivered for our clients

We deliver measurable results with our secure payment processing software and fraud protection solutions — helping businesses recover failed fintech platforms, modernize legacy systems, and protect transactions with AI-driven security.

USA

Sports & Fitness

BetterMe shopify store for sportswear

Solution:

A mobile-first Shopify storefront with custom product recommendation logic, loyalty integrations, and optimized checkout flow, all aligned with BetterMe’s brand identity and massive mobile audience.

Result:

Increased cart conversion rate, faster purchase flow, and stronger brand presence within the BetterMe ecosystem.

Switzerland

Manufacturing

360° shower sales app for duscholux

Solution:

Multi-app platform including a tablet-based product configurator, back-office management dashboard, and mobile installer tracker built with React Native, GraphQL, and Azure DevOps for unified, scalable performance.

Result:

Shorter sales cycles, reduced quoting errors, and improved transparency across sales and installation processes.

USA

Beauty, Cosmetics

Cosmetics analysis AI app – beauty eCommerce + AI

Solution:

A mobile app with a database of 45K+ cosmetics and 800K+ ingredients, AI-powered safety scanning, and product purchase integration designed for global scalability and trust-building.

Result:

Over 100K active users, increased product trust, and monetization through targeted eCommerce sales.

Who benefits from our fraud protection & secure payment solutions

Protecting your payments and preventing fraud starts here: AI-powered fraud detection and secure payment processing solutions that help businesses safeguard transactions, reduce chargebacks, and maintain customer trust.

E-commerce & retail

Online stores using AI-driven fraud protection and secure payment systems to prevent chargebacks, stop suspicious transactions, and ensure smooth, PCI-compliant checkouts.

Financial & banking platforms

Banks, digital wallets, and payment providers deploying AI-powered transaction monitoring, risk scoring, and secure payment gateways to reduce fraud, protect sensitive data, and maintain regulatory compliance.

SaaS & subscription services

Platforms handling recurring billing or memberships relying on fraud prevention and secure payment solutions to ensure uninterrupted revenue, reduce disputes, and deliver seamless customer experiences.

Healthcare & wellness platforms

Telemedicine, insurance, and wellness providers integrating secure payment processing and fraud protection to handle patient billing, insurance claims, and online payments safely and compliantly.

Digital goods & e‑learning providers

Platforms selling media, software, or courses using secure payment processing software and AI fraud solutions to prevent unauthorized purchases, fake accounts, and chargeback disputes.

Travel & booking platforms

Booking websites, travel agencies, and global reservation systems using secure, multi-currency payment workflows with real-time fraud monitoring to prevent losses and maintain trust.

Choose your cooperation option

We offer fraud protection and secure payment processing services in flexible formats — from strategic consulting to full-cycle development — so you can choose what fits your business best.

Fraud & payment system consulting

Get a strategic audit of your existing payment workflows, fraud prevention tools, and system vulnerabilities.

Dedicated team

Expand your team with fraud prevention experts dedicated to stabilizing, optimizing, and scaling your payment infrastructure.

Project maintenance

Stay protected with continuous updates, compliance checks, fraud model improvements, and real-time transaction monitoring.

Custom development engagement

Full-cycle development of secure payment processing solutions, fraud detection systems, or complete platform rebuilds.

Insights from our experts

Ready to modernize your software?

Get a fast, expert assessment of your system with our software modernization services.

FAQs

How do AI-driven fraud protection solutions help reduce chargebacks and prevent payment fraud?

AI-powered fraud tools analyze transaction behavior, device patterns, and historical data in real time. This allows the system to detect unusual activity instantly, block suspicious transactions before they go through, and reduce false positives that frustrate customers. The result is fewer chargebacks, lower losses, and a smoother payment experience.

What makes Onix’s secure payment processing software different from third-party payment providers?

Onix doesn’t rely on generic, plug-and-play tools. Instead, we build custom, PCI-compliant payment systems tailored to your business, risk level, and workflow. You get a scalable architecture, AI-driven fraud detection, and high-performance transaction flows — all designed specifically for your platform rather than a one-size-fits-all solution.

Can you recover or fix an existing payment system that was built by another vendor?

Yes, absolutely. Our team specializes in rescuing and stabilizing payment systems that are failing, outdated, or unreliable. We fix transaction issues, restore broken integrations, improve performance, and modernize critical components without causing disruption to your active operations.

What industries benefit most from your fraud prevention and payment security services?

Any business processing online transactions can benefit, but the strongest impact is typically seen in e-commerce, fintech, multi-vendor marketplaces, subscription and SaaS platforms, travel and booking services, and digital goods or online education providers. Wherever fraudulent activity can occur, our solutions help prevent it.

How long does it take to develop or modernize a secure payment processing system?

The timeline depends on the complexity of your system. Smaller fixes and audits usually take a few weeks. Full gateway integrations or security upgrades often require one to two months. A complete recovery, modernization, or full-scale payment platform build typically ranges from several months to half a year. Once we conduct an initial audit, we provide a precise timeline with clear milestones and a development roadmap.